VA Circular 26-19-23, issued August 9, 2019 and VA Circular 26-29-30, issued November 15, 2019 announced changes to the funding fee. These changes are effective with loans closing (signing) on or after January 1, 2020. Homebridge will address the entitlement and guarantee updates in a separate communication in the near future.

Funding Fee

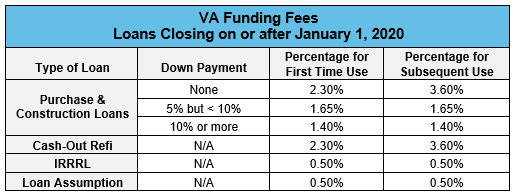

VA is increasing the funding fee on all loan types with the exception of IRRRLs and loans being assumed; those fees will remain unchanged.

Additionally, VA will no longer use the category of service (e.g. regular military, reserves, etc.) to determine the applicable funding fee. The funding fee will be determined by loan type and the same fee will apply to all categories of service.

Funding Fee Exemption

VA also announced that active duty service members who have been awarded the Purple Heart are exempt from the funding fee. The COE must reflect all of the three (3) conditions listed below to be eligible for the funding fee waiver:

- Active duty service member, and

- Purple Heart recipient, and

- Funding fee

Homebridge management will review and approve the COE for eligibility of the funding fee waiver. If the COE does not reflect all three (3) of the conditions, evidence of the Purple Heart award will be required

Loans in the pipeline that do not close (sign) on or before December 31, 2019 will be subject to the new funding fees and will require an updated LE be sent to the borrower.

- Brokered Transactions: Non-IRRRL transactions not closing (not signed) by January 1, 2020, Homebridge will provide an updated LE to the borrower

- NDC/EB Transactions: Non-IRRRL transaction not closing (not signed) by January 1, 2020, the NDC/EB partner is responsible to provide an updated LE to the borrower.

The Homebridge VA and the VA IRRRL guidelines have been updated and posted on the Homebridge website at www.HomebridgeWholesale.com

If you have any questions, please contact your Account Executive