Homebridge is pleased to announce significant enhancements to the Simple Access program including the addition of foreign nationals as eligible borrowers. Highlights of the enhancements are detailed below

- Full Doc, Bank Statement, Asset Qualifier, 1099 Only options:

- 90% LTV/CLTV now available for 1-4 unit primary residence purchase transactions; maximum loan amount $1,500,000 with 720 credit score

- 80% LTV/CLTV now available for 1-4 unit primary residence cash-out refinance transactions; maximum loan amount $1,500,000 with 720 credit score

- Removed the 85% LTV/CLTV restriction applicable to Connecticut, New Jersey, and New York for 1-4 unit primary residence transactions

NOTE: There is NO change to the restrictions for the 5 NYC boroughs/counties, Essex county, NJ and San Francisco county, CA

- Full Doc Option Updates:

- Wage Earner Borrowers:

- The age of paystubs is extended to 120 days (previously 60 days)

- Updated the requirements for borrowers with an employment agreement. Homebridge management review and approval no longer required. Additionally, income is eligible if the borrower will begin employment within 60 days of loan closing

- Removed the additional review requirement for borrowers subject to furlough or salary reduction

- Removed the additional review requirement for borrowers recently converted from W-2 to 1099

- Self-Employed Borrowers:

- The requirement to explain gaps in employment is extended to gaps > 90 days (previously 30 days)

- Extended the age of the YTD P&L to 120 days (previously 60 days)

- Extended the age of the CPA/enrolled agent/tax preparer letter documenting the business to 60 days (previously 30 days)

- Removed additional documentation requirements due to COVID

- Extended the time distributions from non-retirement and retirement account balances must be verified to 120 days (previously 60 days)

- Removed the requirement to document receipt of rents for rental income within 60 calendar days of the Note date

- Removed the requirement for Homebridge management review and approval of short term leases

- Wage Earner Borrowers:

- Bank Statement Option Updates:

- Clarified for borrowers with a 1-2 year history of self-employment:

- The borrower is required to have been in the same line of work for a minimum of 2 years, and

- Borrower is eligible under the 12 months bank statement option only and a minimum of 12 months bank statements supporting the self-employment income is required; 24 months bank statement not eligible

- Extended the age of the CPA/enrolled agent/tax preparer letter documenting the business to 60 days (previously 30 days)

- When documenting income, the newest bank statements in the file cannot be more than 120 calendar days old as of the Note date, based on the end date of the statement

- Lowered the borrower’s ownership interest required to utilize business bank statements to 25% (previously 50%)

- Clarified when documenting rental income, gaps in the rental income is acceptable, however the income will still be averaged over 12 months

- Removed the additional review requirement for co-borrowers subject to furlough or salary reduction

- Clarified for borrowers with a 1-2 year history of self-employment:

- Investor Cash Flow Option Updates:

- Added an exception to the 12 month history of owning and managing rental properties requirement (previously no exceptions allowed). The requirements below apply to all borrowers on the transaction. The 12 month history requirement may be waived subject to:

- Borrower currently owns a primary residence, and

- Purchase transactions only, and

- Minimum 680 credit score, and

- Minimum 1.000 DSCR based on a 30 year amortizing payment, and

- 0x30 in previous 12 months on all housing trade lines as of the loan application date, and

- No mortgage forbearance with a missed payment in the most recent 12 months prior to the application date

- At underwriter discretion request a motivation letter or other documentation to establish the loan as a business purpose loan

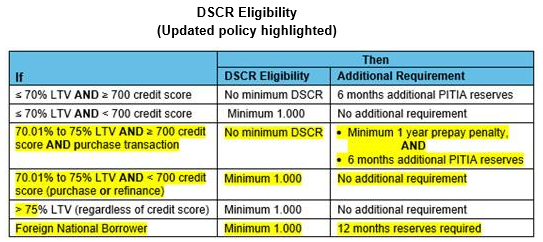

- DSCR requirements have been enhanced (see eligibility chart on next page):

- LTV > 70% to 75% LTV and:

- ≥ 700 credit score AND purchase transaction: No minimum DSCR required. If DSCR is < 1.000 a minimum 1 year prepayment penalty required* and 6 months additional PITIA reserves, OR

- < 700 credit score (purchase or refinance transaction): Minimum 1.000 DSCR required

- LTV > 70% to 75% LTV and:

- Added an exception to the 12 month history of owning and managing rental properties requirement (previously no exceptions allowed). The requirements below apply to all borrowers on the transaction. The 12 month history requirement may be waived subject to:

*IMPORTANT NOTE: If the property is located in a state where a prepayment penalty is not available, the maximum LTV is limited to 70%; 70.01% to 75% LTV is ineligible. The states available for a prepayment penalty are listed in the Simple Access guidelines under the Prepayment Penalty topic

- LTV > 75% LTV (regardless of credit score): Minimum 1.000 DSCR required

- Foreign National borrower (regardless of LTV/credit score): Minimum 1.000 DSCR required

-

- The IO payment may be used to calculate the DSCR when the LTV is ≤ 75% LTV (previously 70% LTV) when using the interest-only feature. The current additional requirements continue to apply

- Clarified when documentation for other real estate owned is required, the mortgage statement(s) provided are required to validate the payment history only; no other documentation is required

- Foreign National borrowers are eligible using the ICF option

- Asset Qualifier Option Updates

- Foreign National borrowers are eligible using Asset Qualifier

- Clarified if assets being used are held jointly with a person who is not a borrower on the loan, only the borrower’s proportionate share is eligible. If no specified ownership percentage is stated, it is assumed the account is divided equally among the account holders

- Asset balance must be verified within 120 days of the Note date (previously 60 days)

- 1099 Only Option Updates

- Removed the requirement for Homebridge management review and approval of short term leases

- Extended the age of YTD income validation to 120 days (previously 60 days)

- Removed additional documentation requirements due to COVID

- General Updates

- Asset Topic Updates:

- Asset statements must cover a minimum of 120 days (previously 60 days)

- Clarified a joint access letter is not required for checking/savings or marketable security accounts held jointly with non-borrowing parties

- Asset Topic Updates:

- Gift Funds topic: The 5% borrower own funds requirement has been removed on primary residence purchase transactions with an LTV of 70% or less

- Removed the requirement for Homebridge management review and approval required for inter vivos revocable trusts

- Title held in the name of an LLC/partnership/corporation:

- Removed the requirement that the entity be single purpose

- Removed the requirement for an attorney opinion letter

- Updated collection/charge-off accounts to allow for the account(s) to remain open when they exceed the currently stated threshold as long as the account does not/will not affect title

- The mortgage/rental history has been updated to only require 0x30 in the previous 12 months in the aggregate (previously 0x30x12 and 0x60 x24 in the aggregate required)

- Housing lates in the previous 12 months that resulted in a significant derogatory credit even are acceptable subject to the applicable documentation option guidelines for derogatory credit

- Properties zoned for agriculture are eligible subject to the following:

- Must be < 20 acres, and

- There is no agricultural use, and

- The appraiser must confirm there is no adverse impact to the marketability of the property as a result of the zoning and confirm there is no agricultural use, and

- Homebridge management review and approval required

- Clarified that properties with a C5 or C6 condition rating are not eligible

- Transferred appraisals are now eligible for one or both appraisals subject to meeting all transferred appraisal requirements (previously only allowed when 2 appraisals required and one could be a transferred appraisal)

- A CDA is required for each appraisal with a variance between 0% and positive 10% (inclusive)

- The transferred appraisal must meet all other Homebridge requirements for transferred appraisals

Foreign Nationals

A foreign national borrower is a person who does not work or reside in the United States; the borrower works and reside in a foreign country. Foreign nationals are now eligible. Highlights are included below; complete requirements can be found in the new Foreign Nationals topic in the Simple Access guidelines.

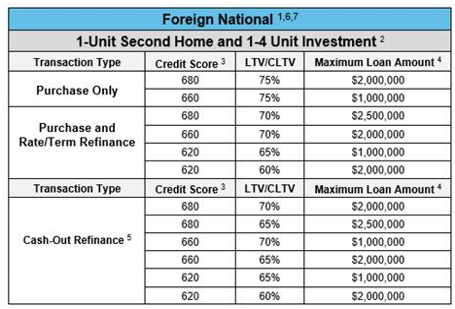

- Eligible under the Investor Cash Flow and Asset Qualifier options only (unique requirements apply are detailed below)

- 1-unit second home (Asset Qualifier option only) and 1-4 unit investment properties eligible

- Purchase, rate/term and cash-out refinance transactions (see Foreign National LTV/credit score/loan amount matrix on following page)

- A valid foreign passport and visa are required. A visa is not required for:

- Canadian citizens,

- Borrowers who are citizens of a country listed on the U.S. State Department’s Visa Waiver Program page at Travel.State.Gov

- Citizens of Mexico may provide one of the following to meet the visa requirement:

- A laser visa card (a border crossing card and B1/B2 visa), or

- A NAFTA treaty visa (TN, TC, E1, or E2)

- All foreign national borrowers must file an IRS Certificate of Foreign Status (IRS form W-8BEN for individual borrowers or W-8BEN-E for entities)

- A social security number is not required; if the borrower does not have a SSN, a credit report and credit score are not required

- Borrowers with a social security number will require a credit report and U.S. credit history will be reviewed and it must meet foreign national credit requirements

- If the borrower has S. mortgage/rental history a 0x30 in the previous 12 months and 0x60 in previous 24 months required. Foreign housing history is not verified

- Foreign credit is not required to be provided, documented, or verified

- When using the Investor Cash Flow option follow ICF guidance except as noted below:

- A minimum DSCR of 1.000 is required, and

- A 12 month history of owning and managing rental property is required, and

- 12 months reserves required, and

- The interest-only payment cannot be used to calculate the DSCR on a loan with the interest-only feature

- When using the Asset Qualifier option follow Asset Qualifier guidance except as noted below:

- Borrower must be qualified using Method Two only: Total post-closing assets must:

- Equal 120% of the subject loan amount, plus

- 30% of all other outstanding U.S. debt (foreign debt/liabilities are not documented or included in the total)

- Any deposits > 10% of the face value of the account(s) must be sourced and documented

- The Homebridge Underwriter will complete a currency conversion

- All funds required for loan closing must be transferred to the U.S. prior to loan closing

- Assets that will be used to satisfy reserve requirements or asset qualification purposes may remain in a foreign account if the financial institution is on the Acceptable Foreign Financial Institutions list (located in the Simple Access guidelines)

- Borrower must be qualified using Method Two only: Total post-closing assets must:

NOTE: If the financial institution in not on the acceptable list, reserve funds must be moved to a U.S. financial institution account prior to closing

- Translation requirements are as follows:

- All foreign documentation must be provided in its original form

- The documentation must be translated to English by a certified translator

- The translator certification documentation is required and is subject to Homebridge management review and approval

- A Know Your Customer check will be performed by Homebridge on all borrowers. If a borrower cannot get a clear KYC check, the loan is ineligible

- The borrower will be required to sign an Automated Clearing House Agreement which will be included with the closing documents. The ACH Agreement facilitates the transfer of electronic funds and must be tied to a U.S. bank account. The bank account must have, at minimum, funds to cover the first month’s loan payment.

- The credit score requirement on the matrix below applies if the borrower has U.S. credit. Borrowers without U.S. credit are eligible subject to the stated LTV/loan amount requirements without regard to the credit score

- Foreign National pricing is subject to the following:

- Borrowers with U.S. Credit: The applicable credit score and Foreign National LLPAs apply

- Borrowers without U.S. Credit: Only the Foreign National LLPA applies

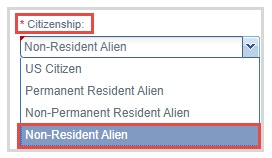

Important Information for Foreign Nationals and P.A.T.H.

The following applies when submitting a loan with a foreign national borrower in P.A.T.H.

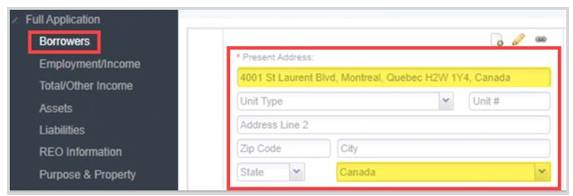

On the Full Application-Borrowers screen:

- Citizenship: When selecting the borrower’s citizenship foreign national borrowers must be identified as a Non-Resident Alien

NOTE: A specific price adjustment applies to foreign nationals, so it is imperative to select the applicable citizenship type to avoid the foreign national price adjustment being applied in error. Non-Resident Alien should ONLY be selected to identify foreign national borrowers

- Present Address Line 1: When entering the borrowers present address the foreign national’s complete address (number, street, city, county/province, country, as applicable), and

- The applicable country must be selected from the drop down menu

The enhancements are effective immediately and may be applied to new submissions and loans currently in the pipeline.

The Simple Access guidelines have been updated and all supporting documentation has been posted on the Homebridge website at www.HomebridgeWholesale.com

The Homebridge rate sheet will reflect foreign national pricing effective August 20, 2021.

If you have any questions, please contact your Account Executive