Homebridge is providing guidance on our tax return requirements for loans funding on or after April 16, 2019 as the deadline for filing taxes is April 15, 2019.

NOTE: Borrowers in the states of Maine, Massachusetts, and in Washington D.C. have until April 17, 2019 to file their taxes due to state holidays; guidance below applies to loans funding on or after April 18, 2019 if subject property in one of these states.

Homebridge W-2/1099 policy is addressed in Homebridge Bulletin 19-01 issued January 3, 2019.

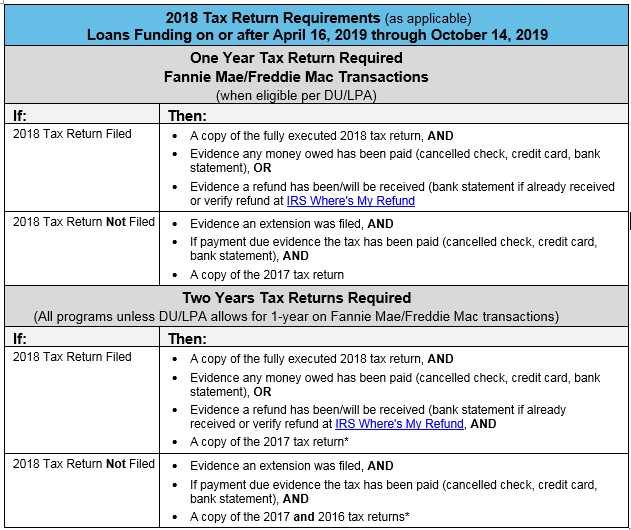

The chart below indicates our requirements based on whether or not one or two year’s tax returns required and if the borrower has filed their 2018 tax returns. The below applies to all programs (as applicable) and to loans run through an AUS or manually underwritten.

*As a reminder, Jumbo/Jumbo Flex, Expanded/Elite Plus, and Simple Access Full/Alt Doc transactions require tax transcripts in addition to the tax returns.

Tax Transcripts (if required)

HomeBridge will order the transcripts for any transaction that requires transcripts or for transactions selected by HomeBridge for random transcript processing.

Any transaction that requires transcripts or, were selected for random processing, will require:

- The 2018 transcript OR

- 2018 “No Record Found