Homebridge is providing guidance on W-2/1099 and tax return requirements. The following policy applies to conventional, government, (including manually underwritten loans), Jumbo/Jumbo Flex, Expanded/Elite Plus, and Simple Access (as applicable).

2019 W-2/1099 Requirements

Federal law requires employers to issue Wage and Tax Statements (W-2) and Form 1099-Misc for the previous year to employees/individuals no later than January 31st of the current year.

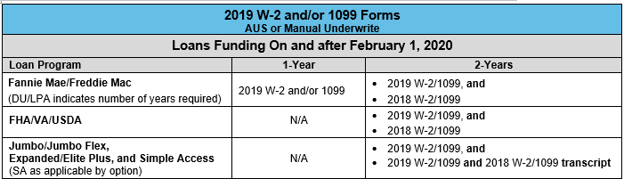

Loans Funding on or after February 1, 2020

When the DU/LPA Findings report or loan program requirements on manually underwritten loans require a W-2 and/or 1099 to support the income used to qualify the loan, the following applies

In the event a borrower has not received their 2019 W-2/1099 Homebridge will consider an exception on a case-by-case basis.

2019 W-2/1099 Transcripts (if required)

Homebridge will order W-2/1099 transcript when required by program or if selected for random transcript processing. The following dates apply only in the event a transcript is required.

Loans Funding on or before March 31, 2020

- The 2019 W-2/1099 transcript not required

Loans Funding April 1, 2020 through April 30, 2020

- The 2019 W-2/1099 transcript, OR

- 2019 “No Record Found