This Bulletin has been updated to amend the Tax Return Affidavit requirement; refer to the highlighted information on page 2 for updated policy

Homebridge is providing guidance on W-2/1099 and tax return requirements. The following applies to conventional, government (including manually underwritten loans), Jumbo, Jumbo Elite, and Simple Access (Full Doc and 1099 Only options) transactions.

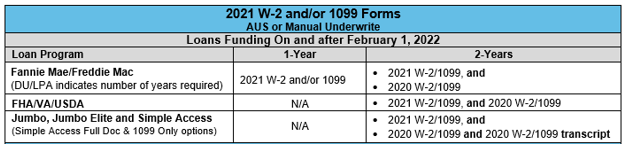

2021 W-2/1099 Requirements

Federal law requires employers to issue Wage and Tax Statements (W-2) and Form 1099-Misc for the previous year to employees/individuals no later than January 31st of each year

Loans Funding on or after February 1, 2022

When the DU/LPA Findings report or loan program requirements on manually underwritten loans require a W-2 and/or 1099 to support the income used to qualify the loan, the following applies:

In the event a borrower has not received their 2021 W-2/1099 by February 1st, Homebridge will consider an exception on a case-by-case basis

2021 W-2/1099 Transcripts (if required)

Homebridge will order W-2/1099 transcript when required by program or if selected for random transcript processing. The following dates apply only in the event a transcript is required.

Loans Funding on or before March 31, 2022

- The 2021 W-2/1099 transcript not required

Loans Funding April 1, 2022, through May 30, 2022

- The 2021 W-2/1099 transcript, OR

- 2021 “No Record Found”

Loans Funding on or after May 31, 2022

- The 2021 W-2/1099 transcript required

2021 Tax Return Requirements

Federal law generally requires tax returns to be filed by April 15, 2022 (see Note below) unless an extension has been requested

NOTE: Due to Washington D.C.’s observance of Emancipation Day, the federal tax filing deadline has been extended to Monday, April 18th

Loans Funding or before April 18, 2022

- A copy of the borrower’s 2021 tax return, OR

- The borrower must sign the Tax Return Affidavit stating they have not filed their 2021 return

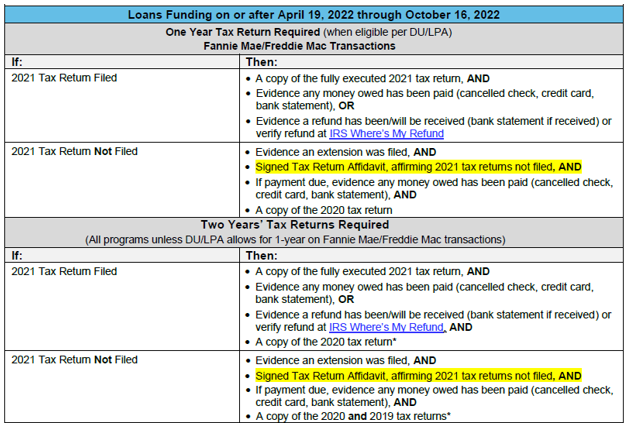

Loans Funding April 19, 2022 through October 16, 2022

The chart below indicates Homebridge requirements for tax returns based on whether or not one or two year’s tax returns required and whether or not the borrower has filed their 2021 tax returns. The chart applies to all programs (as applicable) and to loans run through DU/LPA or are manually underwritten.

NOTE: Borrowers who filed an extension will be required to sign the Tax Return Affidavit that states they have not filed their 2021 tax return

*As a reminder, USDA, Jumbo, Jumbo Elite and Simple Access (Full Doc and 1099 Only) transactions require tax transcripts in addition to tax returns

Loans Funding on or after October 17, 2022

- A copy of the borrower’s 2021 tax return is required

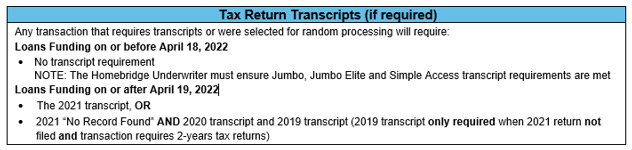

Tax Transcript Requirements (if required)

Homebridge will order the tax transcripts for any transaction where transcripts are required by program or for transactions selected by Homebridge for random transcript processing.

The following dates apply only in the event a transcript is required:

Tax Return Affidavit Requirements (when applicable)

- Brokered Transactions

- When the Tax Return Affidavit is required, Homebridge will provide the Affidavit on transactions where Homebridge is drawing the loan documents

- EB Transactions and Homebridge Prepares Loan Documents

- Homebridge will send the Tax Return Affidavit with the closing doc

- NDC Transactions/EB Transactions and NDC/Fullfillment Provider Prepares Loan Docs

- The NDC/EB is responsible to provide the Tax Return Affidavit with the closing docs

The Tax Return Affidavit has been posted on the Homebridge website on the Forms page under General Forms

The updated Tax Documentation and Transcript Policy document as been posted on the Homebridge website at www.HomebridgeWholesale.com on the Working with Us page, under Reference Guides – General.

If you have any questions, please contact your Account Executive.