VA issued Circular 26-21-26 on December 17, 2021 to clarify the funding fee calculation when the purchase price exceeds the reasonable value and the borrower provides a down payment.

General Information and Reminders

- The funding fee only applies when the borrower is not exempt from paying the fee

- The guidance below applies when determining the applicable funding fee percentage on a purchase transaction with a down payment

- The funding fee may be reduced when a down payment is made on a purchase transaction

- The loan amount cannot exceed the lesser of the appraised value or purchase price

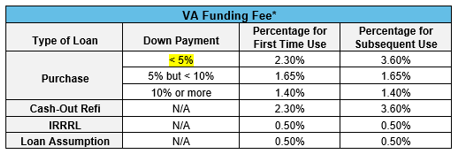

- There is no change to the VA Funding Fee percentages except to clarify the < 5% bucket (previously stated “None”)

Fee Calculation

When determining the funding fee, the percentage of the down payment is calculated as a percentage of the total purchase price of the home

- This includes transactions where the purchase price exceeds the reasonable value of the property established by the appraisal

- Any amount paid by the borrower toward the purchase price, including an amount exceed the appraised value, is included in the percentage down calculation

Example #1 (First time Use and Down Payment is > 5% but < 10%)

- Purchase Price: $300,000

- Appraised Value: $290,000

- Down Payment: $18,000

- The percentage of the down payment is 6% ($18,000 divided by $300,000 = 6%)

- The percentage used for determining the funding fee is 1.65% since the down payment is > 5% but < 10% (see Funding Fee chart above)

Example #2 (First time use and Down Payment is < 5%)

- Purchase Price: $300,000

- Appraised Value: $290,000

- Original Down Payment: $0

- Maximum Loan Amount: $290,000

- Appraised Value is less than Purchase Price so Down Payment Required: $10,000

- The percentage of the down payment is 3.33% ($10,000 divided by $300,000 = 3.33%)

- The percentage used for determining the funding fee is 2.30% since the down payment is < 5% (see Funding Fee chart above)

If you have any questions, please contact your Account Executive