Homebridge is pleased to announce significant enhancements to the Elite Access program. Highlights of the enhancements along with some additional program updates are detailed below.

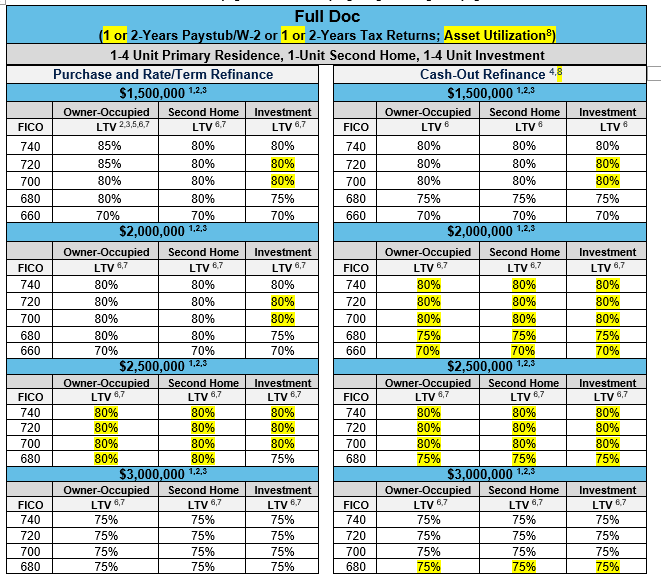

Full Documentation Option

- LTV increased to 80% from 75% (multiple occupancies and loan amounts – see Full Doc matrix)

- Added option for 1-year W-2 or 1-year tax return

- Added Asset Utilization guidance

- Purchase and rate/term eligible; cash-out ineligible

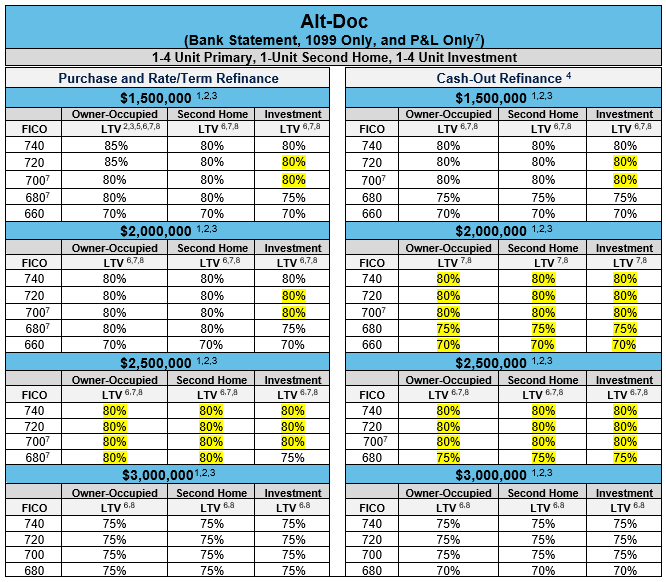

Alt-Doc Option (Bank Statement, 1099 Only, P&L Only)

- LTV increased to 80% from 75% (multiple occupancies and loan amounts – see Alt-Doc matrix)

- Bank Statement:

-

- Bank statements must be dated within 60 days of the Note date (previously within 90 days of Note date and within 45 days of initial application)

- If the income trend is declining and/or irregular a detailed letter of explanation from the borrower is now acceptable

- The variance levels and trend caps for declining income has been removed

- P&L Only:

-

- Updated to only require the most recent 12-month unaudited P&L (P&Ls based on application date no longer required)

Asset Qualifier Option

- Loan amounts < $3,000,000 with minimum credit score 680 now eligible to 80% LTV (previously 75% LTV)

- 6 month asset seasoning requirement removed

- DTI no longer considered

- Updated total post-closing asset requirements to the total sum of the following:

-

- 100% of loan amount plus 60 months of total debt service (subject PITIA or rental properties PITIA not included) plus 60 months of net loss on rental properties plus required reserves

-

- Asset balances must be verified within 10 calendar days of the Note date (previously 90)

NOTE: Refer to guides for complete Asset Qualifier updated policy

Investor Cash Flow (DSCR) Option

- Interest-only now eligible up to $3,000,000 loan amount and up to an 80% LTV (previously maximum $2M loan amount and maximum 75% LTV)

NOTE: Minimum 1.00 DSCR continues to apply

- The reserve requirement may now be determined using the ITIA payment for transactions using the interest-only feature

- 2-4 units now eligible to 80% LTV (previously 75% LTV)

- Subordinate financing is not allowed

- Refinance transactions where the property is leased for more than the appraiser’s opinion of market rents, the following now applies:

- The lease amount may be used up to 125% of market rents (previously not restricted) provided the lease continues for 6 months, and

- Three (3) months of timely rent payments have been received (previously 2 months required)

Additional General Highlights

- Cash-out transactions no longer require a 6 month seasoning (see cash-out transactions for additional details)

- The Visa requirement is waived for non-permanent resident borrowers who hold one of the following EAD types

- CO9, C10, C24, C31, C33

- Borrowers with one of the above EAD types are not required to have a visa

- Accessory unit rental income now eligible

- Texas Section 50(a)(6) loans now eligible

- 1031 Exchange now eligible (investment property only)

- Borrowers with significant derogatory credit now eligible up to 50% DTI (previously restricted to 43%)

- Marketable stocks, bonds, mutual funds eligible at 100% of the verified market value, minus any outstanding loans (previously 70%)

- Updated vested retirement funds asset eligibility for reserves as follows:

-

- Borrowers of retirement age (≥ 59 ½) 100% of the value eligible, minus any outstanding loans (previously 60%), OR

- Borrowers not of retirement age (< 50 ½) 80% of the value eligible, minus any outstanding loans (previously 60%)

- Transactions located in a declining market AND the LTV is > 65% a 5% LTV reduction required (a flat 5% LTV reduction now applies; removed demand/market time/10% reduction requirements)

- Updated property flip transaction guidance with new flexibilities (see guidelines for complete details)

- Interest-Only (Full, Alt/Doc, Asset Qualifier): Interest-only transaction requirements updated as follows:

-

- A minimum 680 credit score no longer required

- Loan amount ≤ $2,000,000 maximum 80% LTV

- Loan amounts > $2,000,000 to $2,500,000 maximum 75% LTV

- Loan amounts > $2,500,000 maximum 70% LTV

- Rate/Term refinance transactions: Cash-back to the borrower now limited to the lesser of 1% of the balance of the new loan amount or $5,000 (previously lesser of 2% or $5,000)

- Rate/Term refinance transactions LTV/CLTV determination is now determined by properties owned less than or more than 12 months (previously based on 9 months)

- Properties owned < 12 months as of the application date: The current appraised value may be used to determine the LTV/CLTV provided the value is supported by the appraisal and the CDA (CDA variance must be less than or equal to 10%)

- Properties owned 12 months or more: The LTV/CLTV is based off the current appraised value

- Cash-Out Refinance Transactions LTV/CLTV Determination:

-

- Properties owned < 6 months (Note date to Note date) the LTV/CLTV is based on the lesser of the original purchase price plus improvements or the current appraised value

- Properties owned ≥ 6 months to < 12 months (measured from acquisition date to application date) the current appraised value may be used to determine the LTV/CLTV provided the value is supported by the appraisal and the CDA (CDA variance must be less than or equal to 10%)

- Properties owned 12 months or more the LTV/CLTV is based off of current appraised value

- Cash-Out transactions now require a 5% LTV reduction as follows:

-

- The subject property was purchased or refinanced in the previous 6 months (measured from Note date to Note date)

- The subject property was listed for sale in the 6 months prior to the application date

- The subject property must be taken off the market and the listing cancelled for a minimum of 3 months prior to the loan application date and

- The LTV reduction is based on the lesser of the list price or appraised value

- New Jersey now an eligible state for a prepayment payment

- New Jersey transactions using a PPP must close in an LLC

- State specific prepayment penalty limitations now apply:

- Illinois: Prepayment penalty only allowed when transaction closing in an LLC and the APR is ≤ 8%

- New Jersey: Prepayment penalty only allowed when transaction closing in an LLC

- Pennsylvania: Prepayment penalty only allowed on 1-2 unit properties and minimum loan amount of $312,159

- Updated FTHBs living rent free requirements to include the following:

-

- Maximum 45% DTI

- Minimum 6 months reserves

- 10% borrower own funds contribution

- Full and Alt-Doc Options Only:

-

- Warrantable condos now eligible to 85% LTV (previously 80%) and non-warrantable to 80% LTV (previously 75%)

- DTI > 45% maximum 80% LTV (previously 75%)

- Added Independent Charter Tax Advisor (CTA) as an eligible designation to prepare both CPA letters and P&Ls

- Clarified that documents prepared by an individual with a Preparer Tax Identification Number (PTIN) are only eligible when the preparer also has any of the following additional designations:

- Certified Public Accountant (CPA), or

- Enrolled Agent (EA), or

- California Tax Education Council (CTEC), or

- Chartered Tax Advisor (CTA). Preparers without one of these designations are not acceptable.

NOTE: A PTIN is a tax identification number required by the IRS for preparers of tax returns. While all tax preparers have a PTIN, not all preparers with a PTIN also hold a CPA, EA, CTEC or CTA designation. Preparers with only a PTIN are not acceptable

- Clarified that if the transaction is HPML and a property flip 2 full appraisals required

- Added guidance to now allow borrowers to use the additional extension to file tax returns available under the IRS Tax Relief for Taxpayers in a Disaster Situation policy

The enhancements and updates detailed above apply to loans registered on or after May 24, 2024.

NOTE: Loans currently in the pipeline are eligible for the improvements regardless of the loan registration date

The Elite Access guides have been updated and posted on the Products and Guidelines page of the Homebridge website.

Important Note: With this update there will be two sets of Elite Access guidelines posted. One set will be for loans registered on or after May 24, 2024 and the other set for loans registered prior to May 24, 2024.

If you have any questions, please contact your Account Executive.