Homebridge is making enhancements and updates to the Access (Non-QM) program as detailed below.

Investor Cash Flow (DSCR)

- The maximum loan amount restriction for an interest-only transaction has been removed when the LTV is 60% or less (previously capped at $2,000,000 regardless of LTV)

- Loans submitted by an MLO who is not currently licensed in the subject property state:

- The maximum LTV is 75% (previously no LTV restriction)

- Iowa has been added as a restricted state for loans submitted by an unlicensed MLO (i.e. the property cannot be located in Iowa)

Bank Statement

- Maximum NSFs allowed have been increased as follows:

- 12 month’s bank statements: Maximum 6 instances within past 12 months (previously 3)

- 24 month’s bank statements: Maximum 12 instances within the past 24 months (previously 6)

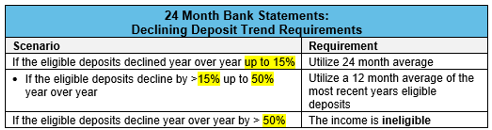

- Income trend requirements have been improved as follow for 24 Month Bank Statements:

- If eligible deposits have declined year over year up to 15%:

- A 24 month average will be utilized (previously 5%)

- If eligible deposits have declined by > 15% up to 50% year over year:

- A 12 month average of the most recent years eligible deposits may be used (previously restricted up to a 15% decline)

- If eligible deposits have declined by > 50%:

- The loan is ineligible (previously ineligible with deposits that declined > 15%)

P&L Only

- Removed the requirement for 2 months business bank statements to support the P&Ls

Foreign National Borrowers: Investor Cash Flow (DSCR) Only

- 75% LTV now available with $2,000,00 loan amount, minimum 700 credit score, and minimum 1.15 DSCR

- 70% LTV now available with $2,000,000 loan amount, minimum 700 credit score, and minimum 1.00 DSCR

- Borrowers without a U.S. credit score maximum 65% LTV

- Cash-out transactions with an LTV of 70.01% to 75% cannot use cash-out proceeds to satisfy reserve requirements

General Enhancements

- Cash-out transactions (Full Doc, Bank Statement, 1099 Only, P&L Only, and ICF)

- Unlimited cash-out now eligible with ≤ 65% LTV (previously 60%)

- LTV > 65% maximum cash-out proceeds $1,000,000 (previously 60%) except ICF:

- ICF Option: Maximum cash-out proceeds $750,000 (previously $500,000)

- Appraisal requirements have been enhanced as follows:

- One full appraisal now required for loan amounts up to $2,000,000 (previously $1,500,00)

- Two full appraisals now required for loan amounts > $2,000,000 (previously > 1,500,000)

- Non-warrantable condominium project requirements have been updated for the following

- The restriction that the transaction can have only one non-warrantable feature has been removed

- Reduced the presale requirement on new projects to 50% (previously 70%)

- The topic has been re-formatted to provide more clarity

- Investment transactions secured by a property located in the state of New Jersey may now offer a prepayment penalty option subject to the property closing in an LLC

- NJ PPP options are ineligible for transactions that are not closing in an LLC

- Homebridge will provide a Guaranty Agreement in the closing documents which must be signed by the borrower

- The loan documents will be required to be signed by the borrower as a managing member only, not as an individual on the Note, Security Instrument, and CD. The personal guarantor/borrower will not sign the Note, Security Instrument, or CD.

General Updates

Investment Property Cash-Out Transactions: All Documentation Options

- All investment property cash-out transactions require cash-out to be used for business purposes ONLY; cash-out proceeds cannot include consolidation of personal consumer debt

- Homebridge will require the borrower to sign a specific Affidavit at loan closing to confirm cash-out proceeds will be used for business purposes only.

- The Affidavit will be required on Full Doc, Bank Statement, 1099 Only, and P & L Only Access investment cash-out transactions and Homebridge will include in the loan document package

NOTE: The new Affidavit is not required on ICF transactions since the existing affidavit

already includes language confirming proceeds are used for business purposes only

Transactions Closing in an LLC

- Transactions closing in an LLC will have the debt reported on the borrower’s individual credit report

The Access (Non-QM) program guidelines have been updated and posted on the Homebridge website at www.HomebridgeWholesale.com

These updates apply immediately to both new submissions and pipeline transactions except as noted below:

- Investment Cash-Out Clarification:

- Applies immediately to all files that are CTC and new submissions

- NJ PPP Improvement:

- Apples immediately to pipeline transactions with a COC and new submissions

- ICF Transactions: Unlicensed MLO New LTV Restriction

- Applies to loans locked on or after December 7, 2023

NOTE: Transactions taking advantage of improved LTVs will require manual locks. To request a manual lock, email the Homebridge lock desk at locks@homebridge.com

If you have any questions, please contact your Account Executive