Fannie Mae DU Release Notes, issued August 11, 2021, announced updates to DU that will occur over the weekend of September 19, 2021. Highlights of the DU update are highlighted below.

Credit Score Eligibility

- DU currently considers the borrower’s credit score as part of the overall DU assessment primarily to ensure the loan meets Fannie Mae’s minimum credit score requirement of 620

- Fannie Mae is updating the credit score used by DU in the eligibility assessment to support homeownership opportunities for underserved borrowers

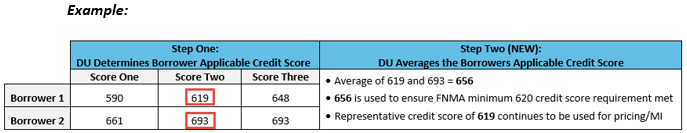

- Loans with more than one borrower, DU will begin using an average median credit score, as detailed below, solely for the purpose of determining if the minimum 620 credit score requirement is met (New)

- DU will determine each borrower’s applicable credit score (middle of three/lower of two), THEN

- DU will average the applicable credit scores for all borrowers on the loan to determine if the minimum 620 credit score requirement has been met (see Example below)

Important Note:

- The averaging of the median credit score is only used by DU when determining if the loan casefile meets FNMA’s minimum credit score requirement (averaging not applicable to RefiNow loans which will continue to use the representative score to determine minimum credit score eligibility)

- The representative credit score (the lowest applicable score of all borrowers) for the loan will continue to be used for pricing and MI requirements (no change to current policy)

Self-Employment Income: Borrowers with < 25% Ownership Interest

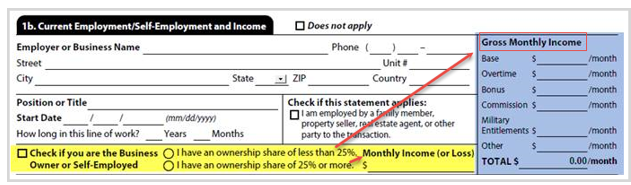

- DU will use the Gross Monthly Income (base, bonus, OT, etc.) stated on the loan application when calculating the total income (currently the Monthly Income (or Loss) field is used)

- Borrowers with < 25% ownership interest should include income in the Gross Monthly Income section of the 1003 (blue fields in the example below)

- Borrowers with ≥ 25% ownership interest, income should be listed in the Monthly Income (or Loss) field (yellow highlight below)

NOTE: The applicable box regarding ownership interest must be checked

New Credit Types

- Additional credit types have been included in the interested party contribution messaging issued by DU:

- Builder developer

- Real estate agent

- Employer affiliate

- Lender affiliate

- Other interested party

- DU will issue a message as a reminder that the lender must verify that the minimum borrower contribution has been made for the transaction (if applicable) and that the contributions by others do not exceed the applicable IPC limits

Other Real Estate Owned

- With this update, the Other Description field in DU may now be used to describe the borrower’s other REO to ensure FNMA’s requirements for multiple financed properties is accurately applied by DU

- Descriptions of the property, such as “commercial”, “multi-family”, “land”, etc. should be entered in the Other Description field

- When this additional information is provided, DU will use this information when applying the eligibility and reserve requirements associated to the multiple financed properties policy

New/Updated DU Messaging

This update to DU also includes new and updated messaging, detailed below

- Eligible Source for Grant Funds

- DU will now issue a message as a reminder that grant funds must come from an entity

- If an individual is identified as the source of the grant, DU will issue an Ineligible recommendation

- Grant/Gift Funds Source Missing

- If the source of the funds are not provided, DU will issue a message that the source of any gift, grants, gift of equity, must be provided and the casefile resubmitted to DU

- Subordinate Financing Source Missing

- The source of new subordinate financing must be provided. If the source is missing, DU will issue a message that the source of all new subordinate financing must be provided and the casefile resubmitted to DU

- Depository Asset Requirements

- DU messaging has been updated to only require a bank statement covering a one-month period on refinance transaction to document bank/investment assets to align with

- RefiNow Messages

- The message issued by DU specifying the P&I payment and the Note rate on the existing loan is moving from the Observation section to the Verification section on the DU UW Findings report

- A reminder message will be issued that the borrower must be receiving the benefit required by FNMA

- The MI message will also be updated to include the MI cert number

- Eligibility Assessment

- DU messaging will provide more clarity when an “Ineligible” recommendation is received

- DU messaging will differentiate between loans that receive an Ineligible recommendation due to eligibility (e.g. exceeds LTV) versus risk (i.e. details will be provided regarding the risk factors that contribution to the Ineligible recommendation)

- Energy Improvements

- When the 1003 indicates energy improvements will be included in the loan and an energy improvement amount is not provided, DU will issue a message that if the transaction is a HomeStyle Energy loan, the dollar amount of the energy improvements must be provided

- FIPS Code Verification

- When a FIPS code is provided on the loan application, DU will use that code to determine the AMI that will be applied to the casefile

- A message will be issued on the DU Finding that confirms the FIPS code provided; the lender is responsible to document the subject property is located in the specified census tract or county

The updates to DU apply to loans submitted or resubmitted to DU on or after the weekend of September 18, 2021.

If you have any questions, please contact your Account Executive.