Fannie Mae will release DU Version 10.0 the weekend of September 24, 2016. New loans submitted to DU on or after September 24, 2016 will be subject to the new guidance detailed below.

Loans submitted to DU Version 9.3 and resubmitted after the weekend of September 24, 2016 will continue to be underwritten to DU 9.3. Highlights of DU 10.0 release are as follows:

Trended Credit

Trended credit data reporting was developed by Fannie Mae as an additional tool in the DU risk assessment model and is being introduced with the release of DU Version 10.0.

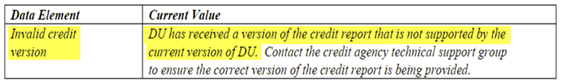

Fannie Mae loans submitted to DU 10.0 will require a credit report that includes trended credit data. DU will issue an error message (see below) if a credit report without trended data is provided. A new credit report, with trended data, will be required in order for DU to issue an underwriting decision.

DU’s credit risk assessment includes:

- Credit history (age of accounts)

- Utilization and payment history (now using trended credit)

- The time frame and severity of accounts with late payments

- Public records, foreclosures, deed-in-lieu of foreclosure, pre-foreclosure sales, mortgage charge-offs and collection accounts

- Inquiries

Trended credit allows DU to analyze if the borrower is a “Transactor