HomeBridge is pleased to announce that effective May 5, 2017 we will be offering Freddie Mac’s Home Possible and Home Possible Advantage programs.

Home Possible/Home Possible Advantage are affordable lending programs designed for first-time homebuyers, move-up borrowers, retirees, very low and low-to-moderate income borrowers and borrowers in underserved areas.

Income Requirements

Property is Not Located in an Underserved Area

The Home Possible programs have the following income requirements for properties not located in an underserved area:

- The borrower’s total annual income cannot exceed 100% of the area median income (AMI), or

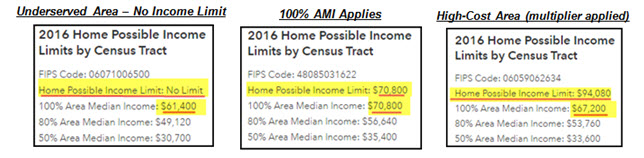

- If the property is in a designated high-cost area the borrower’s total annual income cannot exceed 100% of the AMI plus the high-cost area multiplier applied by Freddie Mac (multiplier varies by property location). To view income multipliers by state/county, click here: Income Multipliers High-Cost Areas

Property is Located in an Underserved Area

- If the property is located in an underserved area there is no income limit applied

Determining Income Eligibility

There are two options available to determine income eligibility based on the property location.

- Loan Product Advisor will indicate income eligibility, or

- The complete subject property address may be entered into Freddie Mac’s Home Possible Income & Property Eligibility The Eligibility tool will indicate if no income limit applies, or the Home Possible income limit based on 100% AMI or, 100% AMI plus high-cost area multiplier:

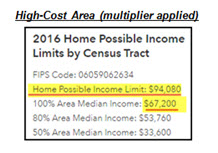

High-Cost Area (multiplier applied) Example:

In the Home Possible income limit for a high-cost area example above the property is located in CA. Freddie Mac applies an income multiplier of 140% to all CA counties.

- 100% Area Median Income for this property is $67,200

- $67,200 multiplied by 1.4 (140%) = $94,080

- The Home Possible income limit for this property is $94,080 (140% of the AMI). In this example the income limit is higher than 100% of the AMI.

Reminder: Manual calculation is not required; the Home Possible Eligibility tool and LPA will provide the applicable multiplier for the high cost area as reflected in the High-Cost Area (multiplier applied) example above

Highlights of the Home Possible programs include:

- Purchase and rate/term transactions

- Conforming loan amounts only; super conforming ineligible

- LPA “Accept