Homebridge is pleased to introduce the Fannie Mae RefiNow program. RefiNow is a refinance option designed for low-income borrowers that offers expanded eligibility to benefit borrowers who are at or below 80% of the area median income (AMI) limit.

RefiNow Overview

- The loan being refinanced must currently be owned by Fannie Mae

- The borrower’s qualifying income (income from all borrowers who will sign the Note) must be ≤ 80% of the Fannie Mae 2021 AMI limit for the area where the property is located.

NOTE: If borrower has other income not used for qualifying, that income is not included when determining if AMI requirement has been met

- The refinanced loan must provide the following borrower benefits:

- A reduction in the interest rate of at least 50 basis points, AND

- A reduction in the borrower’s monthly payment, that includes the principal, interest, and mortgage insurance payment (if applicable), by a minimum of $50

- All borrowers on the loan being refinanced must be on the new loan; borrowers cannot be added to the new loan or deleted from the existing loan except as noted below (exception is for deleting a borrower only; borrowers cannot be added)

- One or more borrower(s) may be deleted only if one of the following applies:

- The remaining borrower(s) meet the RefiNow mortgage payment history requirement (0x30 in previous 6 months and no more than 1×30 in months 7-12), and

- The remaining borrower(s) can provide evidence that they have made the mortgage payments from their own funds from the previous 12 months, OR

- The borrower being removed is deceased and evidence documenting the borrower’s death is provided (e.g. death certificate) and it is documented in the loan file

- If an appraisal is required, Fannie Mae will provide a $500 credit that must be passed on to the borrower

- DU will identify transactions that are eligible for RefiNow as follows:

- All borrowers on the loan being refinanced must be on the new loan; borrowers cannot be added to the new loan or deleted from the existing loan except as noted below (exception is for deleting a borrower only; borrowers cannot be added)

- When a 1-unit primary residence limited cash-out is underwritten in DU and the total income on the loan casefile is at or below 80% of the AMI, DU will determine if Fannie Mae owns the loan, using the subject property address provided on the loan application

- If DU determines FNMA owns the loan and the SSNs are a match, DU will underwrite the loan as a RefiNow

- When none of the SSNs match, DU will issue a message to validate the property address

- If SSN discrepancies are found, DU will issue specific messaging for requirements

- A maximum of $5,000 in closing costs may be included in the new loan amount

- Fannie Mae will waive the Adverse Market Fee for loans with an original principal amount of ≤ $300,000

- RefiNow is eligible for one time use

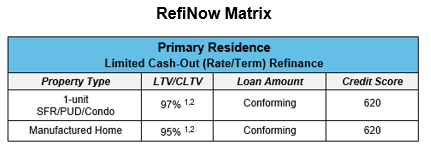

RefiNow Eligibility

- All standard Fannie Mae requirements apply, including any applicable temporary policies in place due to COVID-19, unless indicated below

- Conforming loan amounts only; high balance ineligible

- 1-unit primary residence only

- SFR, PUD, condo (Fannie Mae warrantable) or manufactured homes eligible

- Minimum 620 score

- Maximum 65% DTI

- Maximum LTV/CLTV:

- SFR, PUD, Condo: Maximum 97%

- Manufactured home: Maximum 95% LTV/CLTV

- Transactions where there is a non-occupant co-borrower: Maximum 95% LTV/CLTV

- CLTV up to 105% allowed when a Community Second is being resubordinated

- Payment history on the existing loan requires 0x30 in the most recent 6 months and no more than 1×30 in months 7-12

NOTE: If the borrower was in forbearance due to COVID-19 and had missed payments, and those missed payments have been resolved per Fannie Mae’s standard forbearance plan policy, the missed payments are not considered delinquencies when determining if the above payment history requirements have been met. Refer to the Mortgage/Rental History topic in the Homebridge Fannie Mae Conforming and High Balance Program guidelines posted on the Homebridge website for forbearance plan requirements

- DU determines appraisal requirement; appraisal waivers are eligible if offered by DU

- Standard mortgage insurance requirements apply. DU will identify the current MI provider however the MI coverage for the new loan (if applicable) is not limited to the current insurer

- If the existing loan has lender paid mortgage insurance (LPMI) the loan is not eligible

- Maximum $250 cash-back to the borrower; any excess funds must be applied as a principal reduction

- Fixed rate only

- Recurring alimony and/or child support payments, if applicable, must be considered and the amount of payment and duration must be verified. Acceptable documentation includes a copy of:

- The divorce decree or separation agreement,

- The court order, or

- Equivalent documentation confirming the amount of the obligation

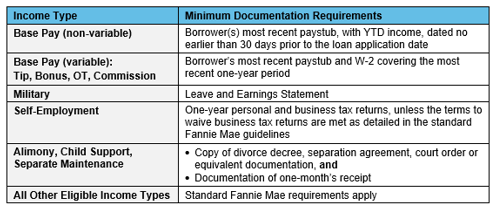

- Income documentation requirements are detailed below:

- Subordinate financing:

- Existing subordinate financing:

- Cannot be paid off with proceeds from the new loan,

- May remain in place if resubordinated to the new loan,

- May be simultaneously refinanced with the existing first lien provided:

- The unpaid principal balance (UPB) of the new subordinate lien is not more than the UPB of the subordinate lien being refinanced at the time of payoff, and

- There is no increase in the monthly principal and interest payment on the subordinate lien

- New subordinate financing permitted only if replacing existing subordinate financing

- Funds to close must be verified with one recent account statement showing asset balance (monthly, quarterly, or annual statement, as applicable)

The RefiNow guidelines have been posted on our website at www.HomebridgeWholesale.com on the Products and Guidelines page.

RefiNow is available for new submissions effective June 25, 2021

The Homebridge rate sheet will reflect RefiNow pricing on June 25, 2021

The Fannie Mae Know Your Options website may be used to determine if Fannie Mae owns a loan

If you have any questions, please contact your Account Executive