Homebridge is pleased to announce the introduction of a Jumbo program. The Jumbo program will be available for new submissions effective July 13, 2020.

Highlights of the Jumbo program include:

- Loan amounts up to $3,000,000 on primary residence purchase and rate/term transactions

- Loan amounts up to $2,500,000 on primary residence cash-out

- Purchase and rate/term investment property maximum 70% LTV/CLTV with loan amounts up to $2,000,000

NOTE: There are no exceptions to loan amounts and any loan amount > $1,500,000 requires Homebridge management approval

- The minimum loan amount is $501,401 for 1-unit and $1 more than the applicable conforming limit for the number of units. Refer to the FHFA website for loan limits by county

- Minimum credit score 700, no exceptions

- Maximum LTV/CLTV 80%

- Purchase, rate/term and cash-out refinance transactions; cash-out ineligible on investment transactions

- 1-4 unit primary residence and investment properties, and 1-unit second home

- SFR, PUDs, condos (attached/detached) that are Fannie Mae warrantable, 2-4 units, and modular/prefabricated eligible

- 2-4 units require a 5% reduction to the maximum LTV/CLTV

- Maximum DTI (no exceptions):

- 43% purchase and rate/term transactions

- 38% cash-out transactions

- Cash-out up to $250,000 with 50% LTV; up to $500,000 with ≤ $50% LTV

- First time home buyers and non-permanent resident aliens eligible. First time home buyer subject to specific requirements if any of the borrowers on the transaction are FTHBs.

- Reserve requirements vary between 6 to 18 months (determined by transaction type, occupancy, and loan amount). Specific requirements for a portion of the required reserve funds to be from non-retirement accounts apply:

- Primary residence: 3 months PITIA (e.g. if 9 months reserves required, 6 months may be in retirement accounts and 3 months must be in non-retirement accounts)

- Second home and investment: 6 months PITIA

- Business funds are ineligible to satisfy reserve requirements

- All derogatory credit events (BK/foreclosure/short sale/deed-in-lieu) require 7 year seasoning, no exceptions

- 0x30 in previous 24 months mortgage/rental history required, no exceptions

- Borrowers with a prior mortgage forbearance are eligible 6 months after the end of the forbearance period subject to specific criteria

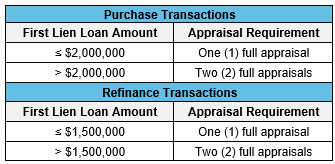

- Appraisal requirements are determined by loan amount and transaction type:

-

- A Collateral Desktop Analysis (CDA) must be obtained for each appraisal required (including when 2 appraisals required). The cost of the CDA is $150 per CDA

- Brokers are required to submit a check, payable to Homebridge, for $150 or 300, as applicable, to the attention of your Account Manager. Mail checks to:

Homebridge Wholesale

5 Park Plaza, 10th Floor

Irvine, CA 92614

Attn: Account Manager Name

-

- Additional requirements for CDAs:

- CDA for One Appraisal Transaction: If the value is “Indeterminate

- CDA for One Appraisal Transaction: If the value is “Indeterminate

- Additional requirements for CDAs: