Homebridge is pleased to introduce a HELOC product in conjunction with Symmetry Lending. The HELOC will be available on Fannie Mae and Freddie Mac transactions and will close concurrently with the Fannie Mae/Freddie Mac first lien (this is not a stand-alone HELOC).

HELOC Overview

Homebridge will facilitate the HELOC with Symmetry Lending. Symmetry will underwrite, draw the docs and fund the HELOC. Highlights of the HELOC offering:

- Eligible with a Fannie Mae/Freddie Mac first lien purchase, rate/term and cash-out 1-4 unit primary resident and 1-unit second home transactions. First lien transactions secured by an investment property are ineligible

- HELOC transactions are not subject to TRID; an LE or CD is not issued

- Maximum combined first lien and HELOC loan amount is $2,500,000

- Maximum HELOC line amount:

- Primary residence: $500,000

- Second home: $250,000

- Minimum HELOC initial draw amount:

- All states (excluding AZ, CA, FL, OR, WA): $25,000

- AZ, CA, FL, OR, WA: $50,000

- HELOC is available in the following states:

- Alabama, Alaska, Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Iowa, Illinois, Indiana, Kansas, Kentucky, Massachusetts, Maryland, Michigan, Minnesota, Montana, North Carolina, Nebraska, New Jersey, Nevada, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Utah, Vermont, Virginia, Washington, Wisconsin, and Wyoming

- Pricing is the current prime rate (4.00) plus applicable margin (determined by credit score).

- Additional add-ons may apply; see guidelines for details

- Pricing is set the day the Homebridge Underwriter submits the HELOC to Symmetry

- HELOC term is 30 years

- Draw period: Years 1 through 10; interest-only payment during draw period

- Repayment period: Years 11 through 30; principal and interest payment amortized over 20 years

- The borrower is qualified on a fully drawn line at the start rate plus 2% amortized over 30 years

NOTE: The Fannie/Freddie first TD is qualified using the payment on the HELOC initial draw

- There is no early termination fee/prepayment penalty

- Refer to the HELOC guidelines for complete details (DTI, FICO, maximum CLTV, borrower and property eligibility, fees, etc.)

- Symmetry requires HELOC borrowers to join a credit union prior to Symmetry CTC. Once initial loan approval is received from Symmetry, the Homebridge Underwriter will send Brokers a link for the borrower to apply to the credit union partnering with Symmetry

Submitting the HELOC in P.A.T.H.

Brokers should follow the steps below when submitting the first trust deed and the concurrent HELOC

- STEP ONE:

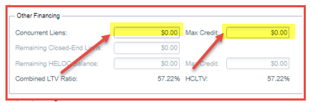

- Identify the HELOC in the Short Application by going to the Other Financing section

- Input the Initial Draw Amount in the Concurrent Lien field, and

- Input the High Credit Amount in the Max Credit field

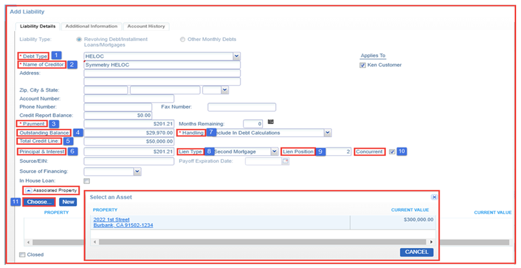

- STEP TWO Identify the Symmetry HELOC on the Liabilities screen of the Full Application

- The following fields are required to be input. Fields with a red asterisk are mandatory fields; all other fields must be completed correctly to avoid AUS issues on the 1st TD:

- 1* – Debt Type (Mandatory Field): Select HELOC from the dropdown

- 2* – Name of Creditor (Mandatory Field): Enter Symmetry HELOC

- 3* – Payment: (Mandatory Field): Enter as applicable (FNMA/FHLMC qualifies using the draw amount; refer to the HELOC Product Presentation for an example)

- 4 – Outstanding Balance: Enter the Initial Draw Amount

- The following fields are required to be input. Fields with a red asterisk are mandatory fields; all other fields must be completed correctly to avoid AUS issues on the 1st TD:

-

-

- 5 – Total Credit Line: Enter the High Credit Amount of the HELOC

- 6 – Principal & Interest: Enter the initial draw payment (same payment amount as field 3)

- 7* – Handling (Mandatory Field): Select Include in Debt Calculations from the dropdown

- 8 – Lien Type: Select Second Mortgage

- 9 – Lien Position: Select Second

- 10 – Concurrent: Place a checkmark in the box

- 11 – Associated Property: If subject transaction is a Refinance, the concurrent lien must be associated to the subject property

-

Submitting the HELOC to Symmetry

- The Homebridge Underwriter will submit the HELOC to Symmetry subject to receiving, at minimum, the following documents:

- Symmetry Borrower(s) Certification and Authorization, signed by all borrowers, and

- Credit report dated within 120 days of submission to Symmetry, and

- Sufficient income and/or documentation for other real estate owned by the borrower for Symmetry to make a credit decision

- Symmetry will pull their own credit report and any credit inquiries must be addressed

- HELOC approval is subject to Symmetry turn times for credit, appraisal, and loan docs

Effective Dates

- Pipeline Transactions: The Symmetry HELOC may be added to an existing Fannie Mae or Freddie Mac first lien pipeline transaction effective immediately

- New Submissions: The Symmetry HELOC is available for loans submitted on or after June 3, 2022

NOTE: If HELOC is added to an existing Fannie Mae/Freddie Mac pipeline transaction a Change of Circumstance is required

HELOC Materials

- Fannie Mae/Freddie Mac Submission Quick Reference Guide

- Symmetry Borrower(s) Certification & Authorization

- Introduction to the HELOC Product Presentation

The HELOC guidelines been posted on the Homebridge website at www.HomebridgeWholesale.com on the Products and Guidelines page. Supporting materials have been posted on the Working with Us page under HELOC Specific.

If you have any questions, please contact your Account Executive