Homebridge is pleased to announce a new AUS option is available on the Jumbo program.

The new Jumbo AUS option allows loans to be submitted to DU or LPA and asset documentation is determined by DU or LPA findings subject to the transaction meeting specific criteria. Additionally, credit score and reserve requirements are lower for certain transactions.

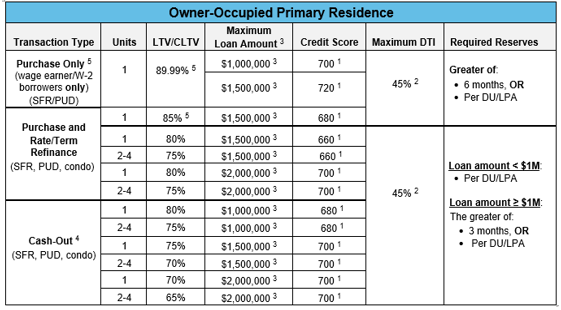

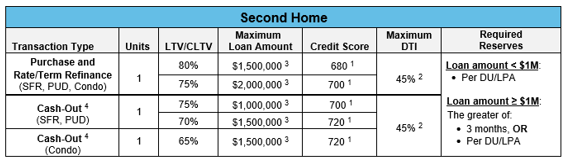

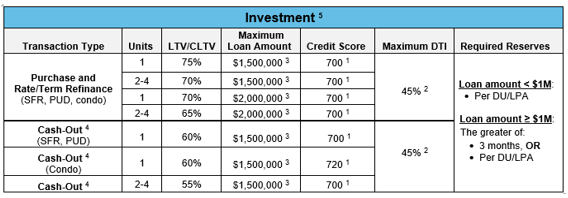

Highlights of the new Jumbo AUS are detailed below and the LTV, loan amount, and credit score matrices are on pages two and three of this Bulletin.

- When a DU Approve/Ineligible or LPA Accept/Ineligible finding (the ineligible finding must only be due to the loan amount) assets may be documented per DU/LPA findings

- Maximum $2,000,000 loan amount

- Minimum loan amount must be $1 more than the county limit where the property is located for the applicable number of units (i.e. $1 more than the conforming or high cost limit, as applicable, where the property is located)

- 1-4 unit primary residence, 1-unit second home, and 1-4 unit investment property eligible

- Eligible property types: SFR, PUD, and condos

- Maximum 89.99% LTV/CLTV

- > 80% LTV/CLTV is limited to wage earner/W-2 borrowers only (applies to all borrowers on the transaction); self-employed borrowers are not eligible > 80% LTV/CLTV

- 01% to 89.99% LTV: Purchase transactions only and 1-unit SFR/PUD eligible

- 01% to 85% LTV: Purchase and rate/term refinance and 1-unit SFR/PUD/condo eligible

- Minimum credit score:

- Primary residence: 660

- Second home: 680

- Investment: 700

- Maximum DTI 45%, regardless of AUS Findings, no exceptions

- Reserve requirements:

- LTV > 80% regardless of loan amount: The greater of six (6) months PITIA or per DU/LPA

- LTV ≤ 80% and:

- Loan amount < $1,000,000: Per DU/LPA

- Loan amount ≥ $1,000,000: The greater of three (3) months PITIA or per DU/LPA

- Appraisal requirements for both purchase and refinance transactions are as follows:

- Loan amount is ≤ $1,500,000: One full appraisal that meets DU/LPA requirements and one of the following:

- A CDA within a 10% variance of the appraised value, or

- A Fannie Mae CU score ≤ 2.5, or

- A Freddie Mac LCA score ≤ 2.5

- Loan amount > $1,500,000: Two full appraisals

- Loan amount is ≤ $1,500,000: One full appraisal that meets DU/LPA requirements and one of the following:

NOTE: An Appraisal waiver/ACE offer by DU/LPA is not eligible; an appraisal must be obtained

- Construction-to-perm and New York CEMA transactions are not eligible

- If business assets are used for closing costs, a letter from a third party (CPA, tax attorney, etc.) is required to document the use of funds will not adversely affect the business

- Business obligations that are payable in less than one year are not required to be deducted from the business cash flow if there is evidence these obligations roll over regularly and/or the business has sufficient liquid assets to cover them

- The loan must meet QM requirements and the Note rate cannot exceed the prime rate plus 1.50%

Jumbo AUS Matrices

The new Jumbo AUS is included in the standard Jumbo program guidelines; the Jumbo AUS matrices begin on page 3 and an AUS – Jumbo Limited Documentation Option topic has also been added. The updated guidelines have been posted on the Homebridge website at www.HomebridgeWholesale.com

Pricing for the Jumbo AUS Option will be reflected on the Homebridge rate sheet as of May 10, 2021.

The Jumbo AUS Option is available for loans submitted on or after May 10, 2021.

If you have any questions, please contact your Account Executive.