Homebridge is pleased to announce the new Jumbo Elite program. The Jumbo Elite is available for new submissions effective October 8, 2021

Highlights of the new Jumbo Elite include:

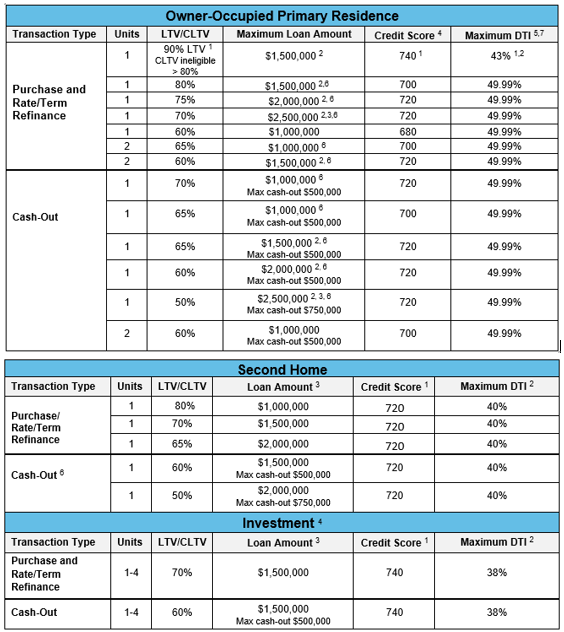

- Loan amounts up to $2,500,000 on primary residence purchase and refinance transactions

- Loan amounts up to $2,000,000 on purchase and refinance second home transactions

- Loan amounts up to $1,500,000 for purchase and refinance investment transactions; cash-out eligible on investment properties

NOTE: Refer to page 3 to view the Jumbo Elite Loan Amount/LTV/Credit Score charts

- 80.01% to 90% LTV eligible for primary residence purchase and rate/term transactions subject to:

- Minimum 740 credit score

- Maximum 43%

- Maximum $1,500,000 loan amount

- Minimum loan amount must be $1 more than the conforming loan limit OR the high cost county limit, as applicable, for where the property is located

- 1-unit primary residence

- Subordinate financing not allowed

- Gift funds not allowed

- Major derogatory credit not allowed (BK, foreclosure, short sale, DIL, etc.)

- Business funds eligible for down payment/closing costs; ineligible to satisfy reserve requirements

- Escrow/impound account required unless prohibited by state law

- Residual income required (determined by number of household members)

- Reserve requirements:

- Non-First time homebuyer ≤ 38% DTI: 12 months PITIA

- Non-first time homebuyer 38.01% to 43% DTI: 18 months PITIA

- First time homebuyer ≤ 38.01% DTI: 15 months PITIA

- First time homebuyers eligible:

- Maximum $1,000,000 loan amount (excluding CA, CT, NJ, NY, WA)

- Maximum $1,500,000 loan amount in the states of CA, CT, NJ, NY, and WA

- Maximum DTI 38%

- Minimum 15 months PITIA reserves

- Non-permanent resident aliens ineligible

- Primary residence purchase, rate/term, and cash-out transactions

- Maximum DTI 49.99%

- DTI 45.01% to 49.99% requires residual income (determined by number of household members)

- First time homebuyers eligible ≤ 80% all states excluding CA, CT, NJ, NY, and WA

- Maximum loan amount $1,000,000

- Primary residence

- Minimum 12 months PITIA reserves required

- First time homebuyers eligible ≤ 80% and property located in CA, CT, NJ, NY, and WA the following applies to loan amounts of $1,000,001 to $1,500,000

- Maximum loan amount $1,500,000

- Primary residence

- Minimum 720 credit score

- No gift funds

- Minimum 15 months PITIA reserves required

- Maximum DTI 49.99%

- Maximum DTI second home and investment:

-

- Second home: 40%

- Investment: 38%

- ≤ 80% LTV the minimum loan amount is $1 more than the applicable conforming loan limit (including high cost counties) for the number of units

- Eligible in all states with the exception of Nebraska

- Cash-out up to $750,000 available

- Projected income eligible on 1-unit primary residence purchase transaction

-

- Borrower has not started employment but has a fully executed non-contingent offer/contract

- A CDA is required when the transaction requires 1 appraisal; CDA not required on 2 appraisal transactions

- An appraisal update is allowed for appraisals > 120 days and < 180 days from the Note date

- Business funds are eligible for down payment/closing costs/reserves when the borrower has < 100% ownership interest

-

- Borrower must have a minimum 51% ownership

- Access letter, signed by other owners, required

- Borrower’s percentage of ownership must be applied to the balance of business funds eligible for use by the borrower

- If business funds used for reserves, the maximum LTV is limited to 65% LTV and the reserve requirement will be doubled

- Self-employed borrowers require an additional 3 months reserves then stated required for the transaction type

- A COVID-19 Borrower Affidavit, signed by the borrowers, will be required on all transactions. Homebridge will provide the Affidavit with the closing documents

Jumbo Elite Loan Amount/LTV/Credit Score Charts

The Jumbo Elite guidelines have been posted on the Products and Guidelines page of the Homebridge website

Jumbo Elite is eligible for Brokered transactions only; NDC/Emerging Bankers not eligible. Additionally, a commitment fee buyout is not allowed

Jumbo Elite program pricing will be reflected on the Homebridge Wholesale rate sheet as of October 8, 2021.

At this time, Jumbo Elite will require a manual lock. Brokers will be required to complete the Manual Lock Request form and email it to the lock desk at locks@homebridge.com The Lock Request form is located on the Forms page of the Homebridge website at www.HomebridgeWholesale.com .

If you have any questions, please contact your Account Executive