Homebridge updated the Simple Access program guidelines as detailed below. The updates detailed below are effective with loans locked on and after December 1, 2022

Investor Cash Flow Option

The ICF option was updated as follows:

- Loans with an LTV of 75.01% to 80% now require a DSCR of 1.15; the option to have a minimum DSCR of 1.00 when the LTV is 75.01% to 80% with a loan amount ≤ $1,000,000 and 740 credit score has been removed

NOTE: There were no changes to the ICF LTV/CLTV/credit score matrix

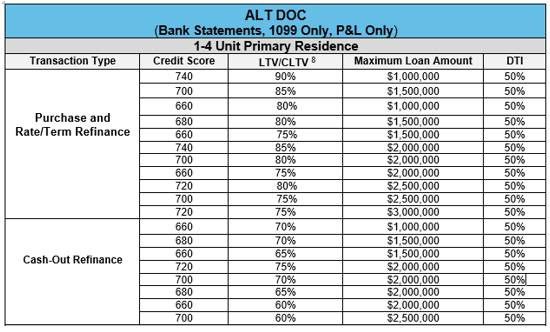

Alt Doc (Bank Statement, 1099 Only, P&L Only) Option

- The 1-4 unit primary residence matrix has been updated for credit score and LTV/CLTV eligibility

NOTE: There were no changes to the Alt Doc Second Home and Investment property LTV/CLTV credit score matrix

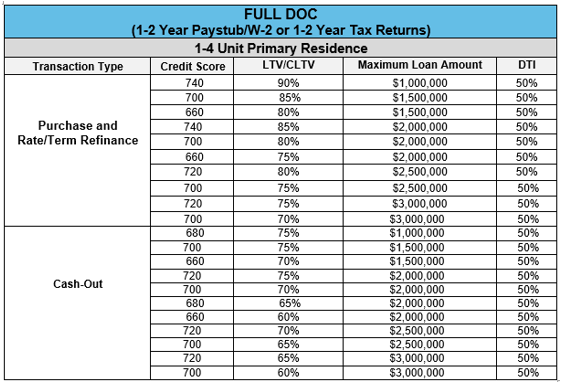

Full Doc Option

- The 1-4 unit primary residence matrix has been updated for credit score and LTV/CLTV eligibility

- The second home and investment property matrix was updated to remove the 85% LTV bucket with a 680 credit score with a $1,000,000 loan amount

Important Guideline Information: Brokers Should Review Carefully

Due to the many recent updates to the Simple Access guidelines that are applicable by loan lock date Homebridge has separated the Simple Access guidelines by lock date. It is imperative Brokers utilize the applicable guidelines to ensure the loan meets all requirements based on the lock date of the loan

- Loans locked on or after December 1st must use the guidelines posted on the website as:

- Simple Access: Loans Locked On or After December 1, 2022

- Loans locked on or before November 30, 2022 must use the guidelines posted on the website as:

- Simple Access: Loans Locked On or Before November 30, 2022

The Simple Access guidelines posted on the website as Simple Access: Transactions Underwritten and Approved On or Before May 2, 2022 have been removed

If you have any questions, please contact your Account Executive