We are pleased to announce enhancements to the Simple Access program as highlighted below.

Prepayment Penalty New Options – Investment Properties Only

- A 4 or 5 year prepayment option will be available for new submissions and loans currently in the pipeline with a change of circumstance beginning Saturday, May 20, 2023 (currently a 1, 2, or 3 year option is offered)

- The prepayment penalty charge has been improved. The prepayment penalty will now be 6 months of interest on the amount prepaid within a 12 month period that exceeds 20% of the original loan amount (previously the prepayment penalty was 2.5% of the amount of prepayment that exceeds 20% of the original loan amount)

- Transactions Registered in P.A.T.H. prior to May 20, 2023: The previous prepayment penalty calculation will be used when Homebridge prepares the loan documents

- Transactions Registered in P.A.T.H. on and after May 20, 2023: The new prepayment penalty calculation will be used when Homebridge prepares the loan documents

As a reminder a prepayment penalty applies when any payment within the preceding 12 months exceeds 20% of the original principal loan amount

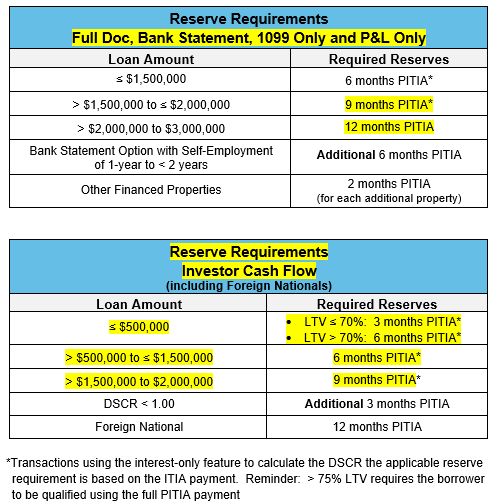

Reserve Requirements

Reserve requirements have been lowered on all documentation options and the Investor Cash Flow option has been separated from the other documentation option reserve requirements

Full Doc, Bank Statement, 1099 Only, and P&L Only Options

Reserve requirements updated as follows:

- Loan amounts > $1,500,000 to ≤ $2,000,000: Reserves lowered to 9 months PITIA (previously 12 months)

- Loan amounts > $2,000,000 to $3,000,000: Reserves lowered to 12 months PITIA (previously 15 months)

Investor Cash Flow Option

Reserve requirements updated as follows:

- Loan amounts ≤ $500,000:

- LTV ≤ 70%: 3 months PITIA or ITIA, as applicable

- LTV > 70%: 6 months PITIA or ITIA, as applicable

- Loan amounts > $500,000 to ≤ $1,500,000: 6 months PITIA or ITIA, as applicable

- Loan amounts > $1,500,000 to $2,000,000: 9 months PITIA or ITIA, as applicable

See updated reserve topic charts on next page

Updated Reserve Requirement Charts

Updates to reserve requirements are highlighted

The reserve requirement update is eligible for new submissions and loans currently in the pipeline as of May 20, 2023.

The Simple Access guidelines have been updated with these changes and posted on the Homebridge website at www.HomebridgeWholesale.com

If you have any questions, please contact your Account Executive.