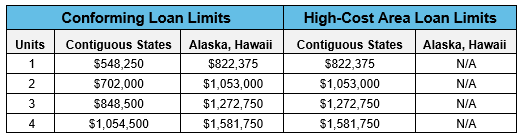

The 2021 conventional loan limits set by the Federal Housing Finance Agency (FHFA) for Fannie Mae and Freddie Mac will apply to VA loans when determining the maximum guaranty amount, if applicable.

The new loan limits are effective for VA loans with closing (signing) on and after January 1, 2021

Loan limits and entitlement requirements do not apply to IRRRLs

Important Reminders Regarding VA Guaranty and Homebridge VA Maximum Loan Amount

Brokers are encouraged to read the below information as it contains specific reminders regarding Homebridge requirements and VA maximum loan amounts

Loan Amount: First Time Use, Veteran has Full Entitlement or Full Entitlement will be Restored

While VA eliminated the use of county limits when determining the guaranty for Veterans with first time use, full entitlement, or full entitlement will be restored, with the Blue Water Navy Act, Homebridge applies the following to VA transactions with 100% financing for all LTVs:

- The maximum total loan amount for a VA loan is $1,500,000. Loan amounts > $1,000,000 to $1,500,000 will require Homebridge management review and approval

- Loan amounts up to $2,000,000 will be considered on a case-by-case basis with Homebridge management review and approval. A down payment, determined by Homebridge management, will be required on loan amounts > $1,500,000 to $2,000,000

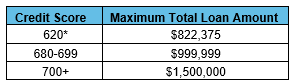

- 1-unit transactions are subject to the following credit score and loan amount restrictions:

*Reminder loans with a credit score of 620-639 have specific requirements: Purchase transactions only, “Approve/Eligible