VA has not yet issued guidance for the 2025 loan limits, however it is anticipated that the 2025 conventional loan limits set by the Federal Housing Finance Agency (FHFA) for Fannie Mae/Freddie Mac will apply to VA loans. In the event VA official policy varies from the guidance below, Homebridge will update our policy accordingly.

Loan limits and entitlement requirements do not apply to IRRRLs

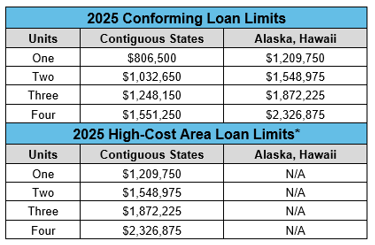

*Actual loan limits for certain high-cost areas may be lower than the maximum loan amount listed above

To view loan limits by county click here: FHFA 2025 Loan Limits

Important Reminders Regarding VA Guaranty and Homebridge VA Maximum Loan Amount

Brokers are encouraged to read the below information as it contains specific reminders regarding Homebridge requirements and VA maximum loan amounts

Loan Amount: First Time Use, Veteran has Full Entitlement or Full Entitlement will be Restored

While VA eliminated the use of county limits when determining the guaranty for Veterans with first time use, full entitlement, or full entitlement will be restored, with the Blue Water Navy Act, Homebridge applies the following to VA transactions with 100% financing for all LTVs:

- The maximum total loan amount for a VA loan is $1,500,000. Loan amounts > $1,000,000 to $1,500,000 will require Homebridge management review and approval

- Loan amounts up to $2,000,000 will be considered on a case-by-case basis with Homebridge management review and approval. A down payment, determined by Homebridge management, will be required on loan amounts > $1,500,000 to $2,000,000

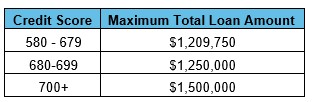

- 1-unit transactions are subject to the following credit score and loan amount restrictions:

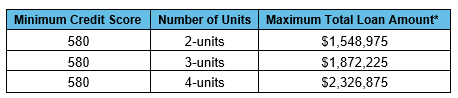

- 2-4 unit transactions are limited to the applicable county limit where the property is located even if the veteran has full entitlement/full entitlement restored/first time use:

*Actual loan limits may be lower than the maximum loan amount listed above

To view loan limits by county click here: FHFA 2025 Loan Limits

Loan Amount: Veteran has Partial Entitlement, Entitlement Cannot be Restored, or the Loan Amount is ≤ $144,000

- 1-4 Units: The maximum loan amount is limited to the conforming limit of $806,500 for all 1-4 unit properties; high balance limits are not eligible

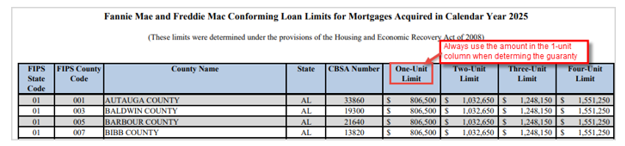

Reminder: The “One-Unit Limit” column is always used to determine the guaranty regardless of the number of units

2025 Loan Limit Eligibility

- Veteran has Full Entitlement/First Time Use/Full Entitlement will be Restored:

- 2025 loan limits may be applied immediately to both pipeline loans and new submissions

- Veteran with Partial Entitlement/Entitlement Cannot be Restored/Loan Amount ≤$144,000:

- 2025 loan limit of $806,500 may be applied to both new submissions and loans currently in the pipeline however the loan must have a Note dated on or after January 1, 2025

NOTE: If a loan with a 2025 loan limit has a Note dated prior to January 1, 2025, the loan will be re-priced as a high balance transaction

A manual lock will be required for transactions locked prior to January 1, 2025 using 2025 limits until December 13, 2024. The Lock Request Form is posted on the Forms page of the Homebridge website under General Forms.

The Homebridge VA guidelines will be updated and will be posted on the Homebridge website at www.HomebridgeWholesale.com; refer to the VA guideline version posted as “Transactions Using 2025 Loan Limits”

If you have any questions, please contact your Account Executive